Earn Rewards faster with the Ace Rewards® Platinum Visa® Card!

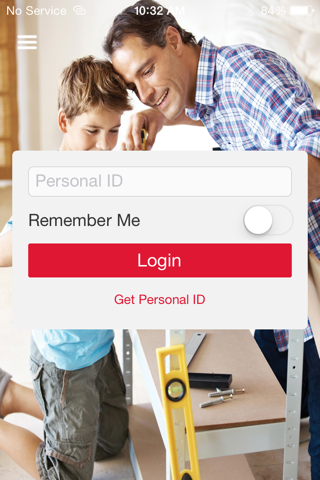

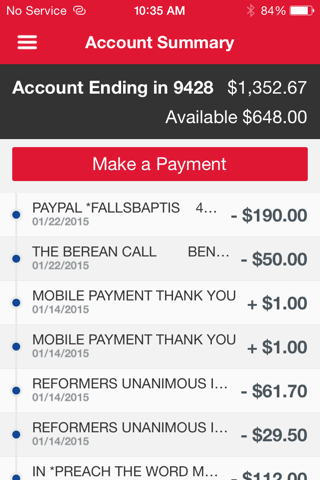

Get the card that rewards you with every eligible purchase, and the app that allows you to access and manage your account anytime, anywhere.

For every $1 of eligible net purchases on your card, (purchases minus credits and returns) you’ll earn:

• Up to 10% in Ace Rewards points quarterly in popular categories (1)

• Up to 5% in Ace Rewards points on Ace purchases (2)(3)

• 2% in Ace Rewards points on gas and groceries (3)

• 1% in Ace Rewards points on eligible purchases everywhere Visa is accepted

• For every 12,500 Ace Rewards points earned, you will receive a $25 Ace Reward

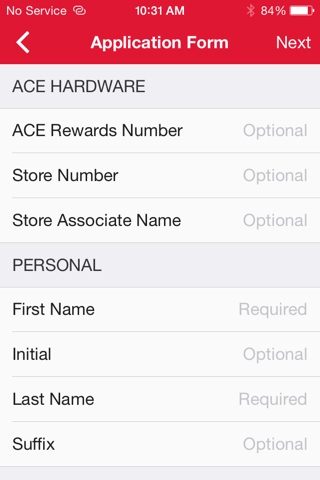

If approved for instant credit, you can shop right away at any Ace Hardware store using a virtual card* and earn up to 5% in Ace Rewards points on your Ace Purchases. (2)(3) Simply show the virtual card to an Ace Associate at checkout. The card will be displayed for 30 days or until you activate the card you receive in the mail.

TERMS & CONDITIONS:

*Subject to instant credit approval.

(1) Earn 10% in Ace Rewards points for each net $1 spent when you use your Ace Rewards Visa Card on category purchases up to the purchase dollar amount cap specified for the category. The 10% in Ace Rewards points is calculated as follows: for every net $1 spent on category purchases, you will earn 1% in Ace Rewards points (5 pts/$1) and an additional 9% in bonus Ace Rewards points (45 pts/$1). Bonus points will be awarded within 6 weeks after the conclusion of each offer. Category purchases in excess of the specified cap will earn Ace Rewards points at the 1% (5 pts/$1) rate for each net $1 spent. To participate, you must be an Ace Rewards Visa Cardmember in good standing (account open for at least 40 days and not over-the-credit limit or past due on the closing date for the billing cycle) and sign up at acerewardsvisa.com for each 10% quarterly offer before the end date for each promotion. U.S. Bank cannot control how merchants choose to classify their business and reserves the right to determine which purchases qualify.

(2) Customers who are approved for the Ace Rewards Visa Card will be automatically enrolled in the Ace Rewards Loyalty program, if they are not already Ace Rewards Loyalty program members. The 5% in Ace Rewards points (25 pts/$1) is calculated based on the 3% (15 pts/$1) earned for every eligible net $1 spent at participating Ace stores plus an additional 2% (10 pts/$1) in Bonus Rewards points on Ace store purchases when you reach a minimum spend of $12,000 anywhere Visa is accepted in a calendar year. The 2% Bonus Rewards points will be awarded in a lump sum on the Cardmembers Ace Rewards Visa periodic statement during the subsequent first quarter of each calendar year.

(3) U.S. Bank cannot control how merchants choose to classify their business and reserves the right to determine which purchases qualify.

The creditor and issuer of the Ace Rewards Visa Card is U.S. Bank National Association, pursuant to a license from Visa U.S.A. Inc.

©2013 U.S. Bank. All rights reserved.

Your privacy and security are important to U.S. Bank and we are committed to protecting your information. Learn more at www.usbank.com/privacy

Continued use of GPS running in the background can dramatically decrease battery life.